Starting or expanding a small business in India often requires capital, but many entrepreneurs struggle to access affordable financing. Recognizing this, the Indian government introduced the Pradhan Mantri Mudra Yojana (PMMY), commonly known as the Mudra Loan Scheme, to empower micro, small, and medium entrepreneurs. This scheme provides collateral-free loans to small business owners, helping them grow their ventures and contribute to the economy.

In 2025, Mudra loans have become more accessible, with flexible terms, low-interest rates, and a wide range of options for diverse business needs. This guide explains what the Mudra Loan Scheme is, eligibility, types, application process, and tips for small business owners to use it effectively.

Why the Mudra Loan Scheme Is Important

Small businesses and self-employed individuals are the backbone of India’s economy. They often face challenges in securing financing from traditional banks due to lack of collateral or credit history. Mudra loans address this gap by:

- Providing Collateral-Free Loans: No security required up to certain limits.

- Encouraging Entrepreneurship: Helps individuals start or expand micro and small businesses.

- Boosting Employment: Small businesses create jobs, driving local economic growth.

- Improving Access to Capital: Covers working capital, equipment purchase, and operational expenses.

- Supporting Women and Minority Entrepreneurs: Special schemes under Mudra focus on inclusive growth.

How People Can Use It:

A self-employed tailor can take a Mudra loan to buy sewing machines, expand production, and increase earnings without pledging property.

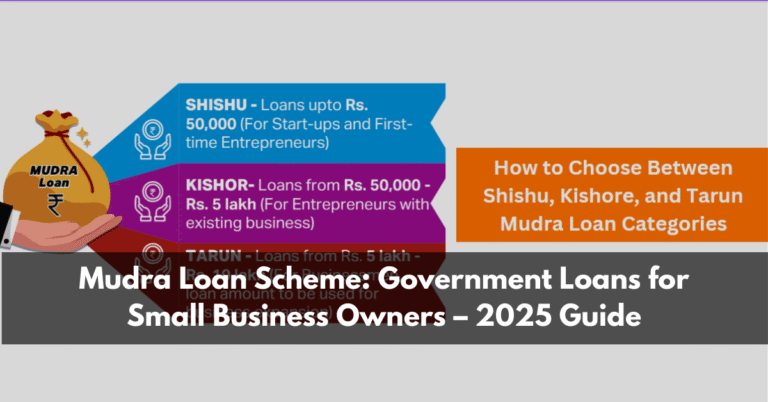

Step 1: Understanding the Types of Mudra Loans

Mudra loans are divided into three main categories based on business size and funding needs:

1. Shishu Loan

- Loan Amount: Up to ₹50,000

- Purpose: Startup or initial stage of micro-enterprise.

- Interest Rate: Low, varies across banks.

- Repayment Tenure: Up to 5 years, flexible.

Example Use:

A street food vendor buys utensils, ingredients, and a cart to start a business.

2. Kishore Loan

- Loan Amount: ₹50,001 – ₹5 lakh

- Purpose: Business expansion or moderate investment.

- Interest Rate: Slightly higher than Shishu loan but affordable.

- Repayment Tenure: Up to 5 years, depending on bank policy.

Example Use:

A tailoring shop expands by purchasing extra sewing machines and hiring staff.

3. Tarun Loan

- Loan Amount: ₹5 lakh – ₹10 lakh

- Purpose: Established business expansion, modernization, or working capital needs.

- Interest Rate: Bank-determined; competitive rates.

- Repayment Tenure: 5–7 years.

Example Use:

A small manufacturing unit invests in new machinery to increase production capacity and revenue.

Step 2: Check Eligibility

Mudra loans are designed for individuals and small businesses that do not have access to traditional bank credit. Eligibility criteria include:

- Business Type: Proprietorship, partnership, or small enterprise involved in manufacturing, trading, services, or self-employment.

- Turnover: Must fall within limits specified for micro or small enterprises.

- Purpose of Loan: Fund must be used for business activity, not personal expenses.

- Age of Applicant: 18 years or above.

- No Prior Default: Borrower should have a clean credit history if previously taken loans.

How People Can Use It:

Before applying, check your business type, financial needs, and repayment capacity to choose the appropriate Mudra loan category.

Step 3: Benefits of Mudra Loans

- Collateral-Free: No security required for loans up to ₹10 lakh.

- Flexible Repayment: Tenure based on business cash flow and loan amount.

- Lower Interest Rates: Compared to conventional unsecured business loans.

- Easy Access Through Banks and NBFCs: Wide network of lenders approved by government.

- Government Support: Partial credit guarantee under CGTMSE reduces bank risk.

- Promotes Entrepreneurship: Helps start, sustain, or expand small businesses without financial strain.

How People Can Use It:

Use Mudra loans to upgrade business equipment, manage working capital, and scale operations without personal asset risk.

Step 4: Required Documents

Lenders require proper documentation to ensure the loan is used for business purposes.

Commonly Required Documents:

- Identity Proof: Aadhaar, PAN card, passport, voter ID.

- Address Proof: Utility bill, Aadhaar, rental agreement.

- Business Proof: Registration certificate, GST certificate (if applicable), partnership deed.

- Bank Statements: 6–12 months to demonstrate cash flow.

- Business Plan or Proposal: Detailing purpose, investment, and projected income.

- Photographs: Passport-sized photos of applicant(s).

How People Can Use It:

Having all documents ready ensures faster loan processing and higher approval chances.

Step 5: Application Process

Step-by-Step Process:

- Choose Loan Type: Shishu, Kishore, or Tarun based on funding requirement.

- Select Bank/NBFC: Mudra loans are available through scheduled commercial banks, RRBs, cooperative banks, and NBFCs.

- Submit Application: Online or offline at bank branch.

- Attach Documents: Identity, business, financial statements, and business plan.

- Verification: Bank evaluates creditworthiness, business potential, and repayment capacity.

- Sanction and Disbursal: Loan approved and credited to borrower’s account.

Example:

A small bakery owner applies for a Shishu loan of ₹40,000. Bank verifies documents and business viability and disburses the amount within 7–10 days.

Step 6: How Interest Rates Work

- Interest rates are determined by banks but generally lower than other unsecured loans.

- Shishu loans typically have the lowest rates, while Tarun loans have slightly higher rates.

- Government guarantees partially cover bank risk, encouraging lower interest rates.

How People Can Use It:

Choose the lowest loan category that meets your needs to benefit from minimal interest rates and manageable EMIs.

Step 7: Repayment and EMI Planning

- Flexible Tenure: 1–7 years depending on loan type and lender.

- EMI Calculation: Principal + Interest spread over tenure.

- Prepayment Option: Some banks allow early repayment without penalty.

Example:

A Kishore loan of ₹2 lakh at 10% interest for 5 years → EMI ~₹4,250. Prepaying extra monthly installments reduces total interest.

How People Can Use It:

- Plan EMIs based on business cash flow.

- Avoid default by keeping an emergency fund for loan repayment.

- Use prepayment when profits allow to reduce interest burden.

Step 8: How Small Business Owners Can Use Mudra Loans Effectively

- Start a New Business: Purchase equipment, raw materials, or initial inventory.

- Expand Existing Operations: Add machinery, hire staff, or open new outlets.

- Manage Working Capital: Cover day-to-day operational expenses like salaries, rent, and utilities.

- Upgrade Technology: Invest in software, IT infrastructure, or automation for efficiency.

- Diversify Business: Introduce new products or services without dipping into personal savings.

Example:

A small textile business uses a Tarun loan to buy automated stitching machines and increase production by 50%, generating higher revenue.

Step 9: Tips to Get Approved for a Mudra Loan

- Maintain a Clean Credit History: Banks prefer applicants without defaults.

- Choose the Correct Loan Category: Shishu, Kishore, or Tarun based on funding needs.

- Prepare a Solid Business Plan: Shows purpose, projected revenue, and repayment ability.

- Provide Accurate Documents: Complete and authentic documentation speeds up approval.

- Consider Co-Applicants or Guarantors: Helps in securing higher amounts if needed.

- Compare Banks and NBFCs: Interest rates, processing fees, and repayment flexibility vary.

How People Can Use It:

Entrepreneurs with proper planning, documentation, and credit discipline get faster approval and lower interest rates.

Step 10: Common Mistakes to Avoid

- Applying for a higher loan than required.

- Submitting incomplete or inaccurate documents.

- Ignoring interest rates and prepayment options.

- Misusing the loan for personal expenses.

- Neglecting repayment discipline.

How People Can Use It:

Avoiding mistakes ensures smooth processing, timely disbursal, and healthy business growth.

Step 11: Government Support and Benefits

- Credit Guarantee Fund Scheme: Reduces lender risk, enabling collateral-free loans.

- Financial Literacy Programs: Government conducts awareness sessions for Mudra borrowers.

- Inclusive Entrepreneurship: Special focus on women, SC/ST entrepreneurs under schemes like Stand Up India.

- Digital Loan Application: Some banks allow online Mudra loan applications for faster processing.

How People Can Use It:

Leverage government programs to reduce financial burden, access training, and grow businesses efficiently.

Step 12: Post-Loan Management

- Keep track of EMIs and repayment schedules.

- Maintain proper accounts and business records.

- Monitor fund utilization to ensure loan is used for business purposes.

- Plan prepayments when surplus revenue is available to reduce interest.

- Maintain regular communication with the bank for queries or assistance.

How People Can Use It:

Effective post-loan management improves creditworthiness and opens doors to higher funding in the future.

Step 13: Success Stories and Practical Uses

- Street Vendors: Started with Shishu loans, expanded to small shops, increased revenue by 3–4 times.

- Women Entrepreneurs: Avail Stand Up India combined with Mudra to set up boutique or food business.

- Small Manufacturers: Used Tarun loans to purchase machinery and scale production.

- Self-Employed Professionals: Tailors, carpenters, and electricians used loans for tools and marketing.

How People Can Use It:

By following the right steps, small business owners can leverage Mudra loans to achieve sustainable growth, create jobs, and improve livelihoods.

Conclusion

The Mudra Loan Scheme has revolutionized small business financing in India, providing collateral-free loans, flexible terms, and government support. In 2025, small business owners and entrepreneurs can leverage this scheme to start, sustain, or expand their ventures while managing interest and repayment efficiently.

Key Takeaways:

- Choose the right loan category: Shishu, Kishore, or Tarun.

- Ensure eligibility and maintain a clean credit record.

- Prepare proper documents and a solid business plan.

- Compare banks and NBFCs for interest rates and repayment flexibility.

- Leverage government support, credit guarantees, and digital application facilities.

- Manage EMIs, prepayments, and fund utilization strategically.

By following these steps, small business owners in 2025 can access affordable financing through Mudra loans, scale operations, and achieve entrepreneurial success without financial stress.