Managing money isn’t just about earning more — it’s about saving smartly. One of the most common questions people have is: “How much should I save every month?” While there’s no universal one-size-fits-all answer, your age plays a big role in shaping your savings strategy. Why? Because as you grow older, your financial responsibilities, income levels, and life goals evolve.

In this blog, we’ll break down savings strategies decade by decade, explain how much you should ideally save every month, and give you actionable tips to reach your financial goals without feeling deprived.

Why Does Age Matter in Saving Money?

Your 20s are about building habits and starting early. Your 30s are often about family responsibilities, buying a house, or planning for kids. Your 40s may be about preparing for retirement and paying off debts, while your 50s and 60s are focused on securing your retirement corpus.

The earlier you start saving, the more time your money has to grow through compound interest. For example, saving ₹5,000 a month from age 25 can grow into much more than saving ₹10,000 a month starting at age 35 — simply because your money had an extra 10 years to compound.

General Rule of Thumb for Saving

Before diving into age-based savings, let’s consider two simple rules you can use as a guideline:

-

50-30-20 Rule – Spend 50% on needs (rent, groceries, bills), 30% on wants (entertainment, travel), and save/invest at least 20%.

-

Income Percentage Rule – Save 20–30% of your monthly income. If you earn ₹50,000, that’s about ₹10,000–₹15,000 saved every month.

But how you allocate this savings depends on your age and financial stage in life.

Saving in Your 20s: Building a Strong Foundation

Your 20s are usually when you start your first job, get your first salary, and enjoy financial independence. It’s tempting to spend everything on lifestyle upgrades, but this is the best time to start saving early.

-

How much to save?

At least 20–30% of your income. If you earn ₹30,000, try saving ₹6,000–₹9,000 every month. -

Where to put your savings?

-

Emergency Fund: Start with 3–6 months of expenses.

-

SIP in Mutual Funds or Index Funds: Invest ₹5,000/month for long-term wealth.

-

Retirement Accounts: Even a small contribution now will multiply hugely later.

-

-

Example: If you save ₹8,000/month from age 23 and invest at 12% returns, by age 40 you’ll have over ₹50 lakh — just by starting early.

👉 Tip for 20s: Don’t worry about the amount; focus on building the saving habit. Even ₹2,000 a month matters if you’re consistent.

Saving in Your 30s: Balancing Family & Goals

Your 30s bring more financial responsibilities — maybe marriage, kids, EMIs for a house or car, and rising expenses. But your income also grows, so you should still prioritize savings.

-

How much to save?

At least 25–30% of your income. If you earn ₹70,000, save ₹17,500–₹21,000 monthly. -

Where to put your savings?

-

Continue SIPs for wealth creation.

-

Buy Term Insurance & Health Insurance for protection.

-

Start saving for children’s education or future goals.

-

Retirement savings should be 10–15% of your salary minimum.

-

-

Example: If you invest ₹20,000/month from age 30 till 60 at 12%, you’ll retire with nearly ₹7 crore.

👉 Tip for 30s: Don’t ignore retirement while focusing on immediate goals like home EMIs or kids’ school fees. Balance is key.

Saving in Your 40s: Catching Up & Securing Future

By 40, you may have bigger financial commitments — kids’ higher education, home loan repayments, and lifestyle expenses. This is also when people realize they need to “catch up” for retirement.

-

How much to save?

At least 30–35% of income. If you earn ₹1 lakh, save ₹30,000–₹35,000 monthly. -

Where to put your savings?

-

Maximize retirement funds like NPS, EPF, or PPF.

-

Reduce risky investments; shift towards safer instruments gradually.

-

Ensure you are debt-free by late 40s.

-

Build a strong corpus for children’s education/marriage.

-

-

Example: Starting at 40 with ₹30,000/month for 20 years at 10% returns will give you about ₹2.3 crore at retirement.

👉 Tip for 40s: Re-evaluate your lifestyle. Cut unnecessary expenses and increase savings aggressively. It’s your last big push before retirement planning takes priority.

Saving in Your 50s: Retirement in Sight

Your 50s are about maximizing your retirement corpus and reducing debt. With kids becoming independent, you can focus more on yourself.

-

How much to save?

Around 35–40% of income, if possible. -

Where to put your savings?

-

Prioritize retirement funds like PPF, NPS, annuities.

-

Move investments into safer options (FDs, debt mutual funds).

-

Ensure you have health insurance — medical costs can drain savings.

-

Pay off all debts before retirement.

-

👉 Tip for 50s: Protect your money from market volatility. Capital preservation is more important than high returns now.

Saving in Your 60s: Retirement & Beyond

By 60, you’re ideally retired or close to it. Your focus should be on using your savings wisely, not taking big risks.

-

How much to save?

You won’t be “saving” much, but rather managing withdrawals. Ideally, you should have 25x your annual expenses saved. -

Where to put your savings?

-

Low-risk options: SCSS (Senior Citizens Savings Scheme), Post Office MIS, Fixed Deposits.

-

Annuities for regular income.

-

Avoid risky equity markets unless you have surplus funds.

-

👉 Tip for 60s: Follow the 3-bucket strategy: keep 1–2 years’ expenses in savings account/FD, mid-term needs in debt funds, and a small portion in equities for growth.

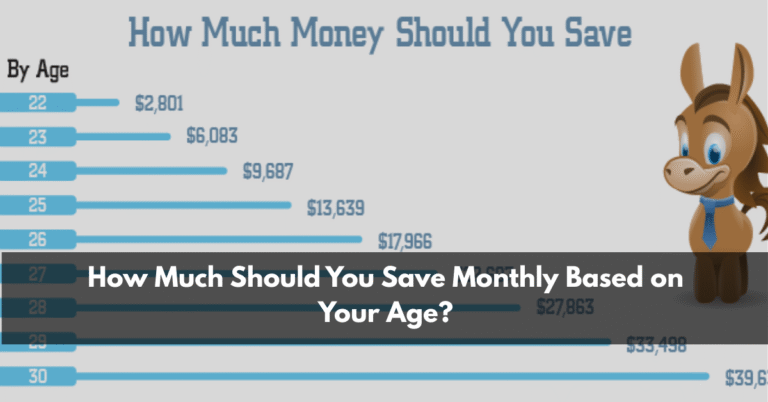

A Quick Age-Wise Saving Breakdown

How to Stay Consistent With Saving

-

Automate Savings: Set up auto-debit for SIPs or recurring deposits.

-

Increase Savings with Income: Each salary hike, increase savings, not just lifestyle.

-

Track Expenses: Use apps to monitor spending and avoid overspending.

-

Set Clear Goals: Saving without purpose is hard; define goals (house, travel, retirement).

Final Thoughts

How much you should save monthly depends on your age, income, and financial goals. Starting early in your 20s gives you the biggest advantage, but it’s never too late to begin. Even if you’re in your 40s or 50s, consistent saving and smart investing can still secure your future.

Remember: It’s not about how much you earn, but how much you save and invest consistently.

👉 Start today, even with a small amount — because the best time to save was yesterday, and the next best time is now.