Filing your Income Tax Return (ITR) might sound like a complicated process, but in today’s digital world, it has become much simpler thanks to the government’s online portals. Whether you are a salaried employee, a freelancer, a small business owner, or a startup founder, filing ITR is both a legal requirement and an important step toward managing your financial health.

In India, ITR is not just about paying taxes—it’s also a way of documenting your income, showing compliance with laws, and building credibility for future financial needs such as applying for a loan, visa, or government benefits. Many people delay or avoid filing due to lack of awareness, but the truth is, the process is straightforward if done step by step.

This blog will explain everything in detail: what ITR is, why it matters, the documents you need, how to choose the correct ITR form, and finally, a complete step-by-step guide to filing it online. We’ll also cover tips to avoid mistakes and how individuals can use this process for financial benefits.

What is an Income Tax Return (ITR)?

An Income Tax Return is a form that taxpayers in India use to declare their:

-

Income earned during a financial year

-

Tax paid on that income

-

Deductions claimed under various sections

-

Refunds (if extra tax was paid)

The Income Tax Department uses ITR to assess whether you have paid the correct amount of tax or if you are eligible for a refund.

Why is Filing ITR Important?

-

Legal Requirement – If your income exceeds the basic exemption limit, filing ITR is mandatory.

-

Proof of Income – Banks, embassies, and government institutions accept ITR as income proof.

-

Loan and Credit Card Approvals – Lenders often check past ITRs before sanctioning loans.

-

Visa Applications – Many countries require ITRs as part of visa processing.

-

Claiming Refunds – If you paid excess TDS, filing ITR is the only way to claim refunds.

-

Carry Forward of Losses – Business or capital losses can only be carried forward if ITR is filed on time.

Who Should File an ITR?

You should file an ITR if:

-

Your income exceeds ₹2.5 lakh (basic exemption; higher for senior citizens).

-

You are a company, firm, or LLP (regardless of profit or loss).

-

You want to claim a tax refund.

-

You earned income from foreign assets or investments.

-

Your bank deposits, expenses, or foreign travel exceed certain limits set by the IT Department.

Documents Needed to File ITR

Before filing, gather these documents:

-

PAN card (Permanent Account Number)

-

Aadhaar card (mandatory for verification)

-

Form 16 (issued by employer, showing salary and TDS)

-

Form 26AS & AIS/TIS (tax credit statement from the IT portal)

-

Bank account details (for refund processing)

-

Investment proofs (PF, LIC, PPF, ELSS, NSC, etc. under 80C, 80D, etc.)

-

Home loan certificates (if applicable)

-

Capital gains statements (if you sold shares, mutual funds, or property)

-

Business/professional income details (for self-employed or business owners)

👉 Having these documents ready ensures smooth filing without errors.

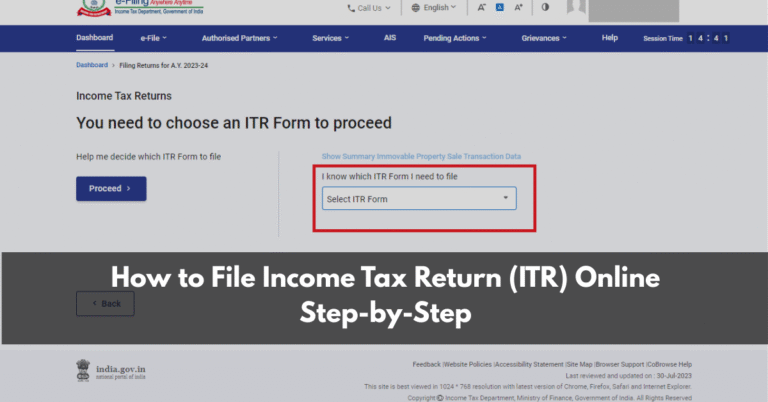

Step 1: Choose the Right ITR Form

There are different types of ITR forms depending on your income source:

-

ITR-1 (Sahaj): Salaried individuals with income up to ₹50 lakh, one house property, and other simple income sources.

-

ITR-2: Individuals/HUFs with income above ₹50 lakh, capital gains, multiple properties, or foreign income.

-

ITR-3: For individuals with business/professional income.

-

ITR-4 (Sugam): Presumptive taxation scheme (small businesses with turnover up to ₹2 crore).

-

ITR-5, ITR-6, ITR-7: For firms, companies, and trusts.

👉 Salaried employees usually file ITR-1, while freelancers and small businesses often use ITR-3/ITR-4.

Step 2: Register or Login to the Income Tax e-Filing Portal

-

Visit: https://www.incometax.gov.in/

-

Click on Login.

-

Use your PAN number as the user ID.

-

If new, click on Register and complete details like PAN, Aadhaar, contact number, and email.

-

Verify registration with OTP sent to your mobile and email.

Step 3: Select the e-Filing Option

You can file ITR in two ways:

-

Online Mode: Directly enter details on the portal (simpler for salaried individuals).

-

Offline Mode: Download the utility (Excel/Java), fill details, and upload XML file.

Most individuals today prefer online mode as it’s easier and error-free.

Step 4: Start Filing Your ITR

Once logged in:

-

Go to e-File > Income Tax Return > File Income Tax Return.

-

Select:

-

Assessment Year (AY) – e.g., FY 2024-25 corresponds to AY 2025-26.

-

Filing Type – Original or Revised return.

-

Status – Individual, HUF, Company, etc.

-

-

Choose the correct ITR form (system often suggests based on your profile).

Step 5: Pre-Filled Information

-

The portal auto-fills details like PAN, Aadhaar, bank accounts, TDS from Form 26AS, and salary details from Form 16 (if employer has uploaded).

-

Review carefully to ensure accuracy.

👉 Many people blindly accept pre-filled data, but mistakes in TDS or salary entries can cost you. Always cross-check.

Step 6: Fill in Income Details

Manually enter or confirm:

-

Salary Income – Verify with Form 16.

-

House Property Income – Rental or self-occupied.

-

Business/Profession Income – Net profits as per books.

-

Capital Gains – From shares, property, or mutual funds.

-

Other Sources – Interest from savings, FDs, dividends, etc.

Step 7: Claim Deductions

Under various sections of the Income Tax Act, deductions help reduce taxable income. Common ones:

-

80C: Investments like PPF, ELSS, LIC (limit ₹1.5 lakh).

-

80D: Health insurance premiums.

-

80E: Education loan interest.

-

80G: Donations to charity.

-

24(b): Home loan interest (₹2 lakh max for self-occupied property).

👉 Salaried individuals should confirm deductions already considered by the employer, and add any missed ones.

Step 8: Calculate Tax Liability

The portal automatically computes tax based on:

-

Applicable tax slab (old vs new regime).

-

Deductions claimed.

-

Advance tax/TDS paid.

If extra tax is due, you can pay online via Challan 280 (available on the portal).

Step 9: Verify Bank Account

Refunds are credited directly to your bank account. Ensure:

-

Account is linked with PAN and Aadhaar.

-

Account is pre-validated in the portal.

Step 10: Submit & e-Verify ITR

After checking details:

-

Click on Submit.

-

Now e-verify return within 30 days, otherwise it is considered invalid.

Ways to e-verify:

-

Aadhaar OTP

-

Net banking

-

Bank account/Demat account EVC

-

Sending a signed physical ITR-V form to CPC, Bengaluru

👉 Aadhaar OTP or net banking is the fastest and easiest.

Step 11: Acknowledgement

Once verified, you will get an ITR-V acknowledgement on your email and portal dashboard. This is proof of filing. Refunds, if any, are usually processed within a few weeks.

How People Can Use ITR Filing for Their Benefit

-

Better Loan Approvals – Regular ITRs show consistent income, improving your eligibility.

-

Tax Refunds – Ensures you get back any extra TDS deducted.

-

Avoid Penalties – Late filing attracts fines up to ₹5,000.

-

Builds Creditworthiness – Shows financial discipline, helpful for business owners and startups.

-

Legal Security – If questioned by IT Department, having ITRs ensures transparency.

Common Mistakes to Avoid

-

Filing with incorrect ITR form.

-

Not reconciling Form 16, 26AS, and AIS.

-

Forgetting to report interest income from savings/FDs.

-

Using wrong bank details for refunds.

-

Missing the deadline (usually 31st July for individuals).

Quick Example

Imagine Rohit, a salaried employee earning ₹8 lakh annually.

-

He receives Form 16 from his employer.

-

He claims deductions under 80C (₹1.5 lakh in PPF & ELSS) and 80D (₹20,000 for health insurance).

-

After deductions, his taxable income reduces to ₹6.3 lakh.

-

Using the old regime, his tax liability is ₹33,800.

-

His employer already deducted ₹35,000 TDS.

-

By filing ITR, Rohit gets a refund of ₹1,200.

👉 Without filing, he would lose this refund.

Conclusion

Filing your Income Tax Return online is no longer a tedious task. With the government’s e-filing portal, pre-filled details, and simple verification methods, individuals and small business owners can complete the process in less than an hour.

The key is to be prepared with documents, choose the right ITR form, claim all deductions, and file before the deadline. Once you make ITR filing a habit, it not only keeps you compliant but also opens doors to financial growth and opportunities.

The bottom line: Don’t see ITR as a burden—see it as a tool for financial credibility and security. Start early, file smart, and use your tax returns to your advantage.